Last week I was so excited to show off my Spring capsule wardrobe with you all. I got some questions and emails regarding the capsule wardrobe and one thing people wanted to know the most is how I was able to pull of my wardrobe secondhand. Today I wanted to share how I did manage to keep my capsule wardrobe 90% secondhand and how you can do the same with your wardrobe.

I have always loved to shop secondhand for clothing and the fun of that just has never ended for me. There is such a thrill in the hunt for the perfect item. When I was a girl we would visit a store in my great-grandma’s town that had barrels of clothing to dig through. I remember my mom shuddering and me clapping my hands with glee. I loved to hunt and who knew what treasure you could find at the bottom of a barrel? It could be something really exquisite and rare like J. CREW or BANANA REPUBLIC or ESPRIT or UNITED COLORS OF BENETTON. RARE, RARE, RARE. For a girl who couldn’t afford to upgrade her wardrobe, this possibility thrilled me.

When I was young though I was simply attracted to brand names that I could not afford and deals…oh, THE DEALS. What I ended up with were loads of items that didn’t look good, that didn’t work together, and things I didn’t REALLY love. If only you could have seen the label on the inside though…you might have been impressed. As an adult, I have learned to be patient, to choose wisely, and to try to be flexible when piecing together a secondhand wardrobe.

The capsule wardrobe requires a well-edited closet, selecting pieces that work together and that can be worn many different ways to maximize your choices. You might think secondhand couldn’t work, but I will share my secret with you…consignment shopping online has transformed the impossible and multiple trips to shops into the possible.

(source Kendi Everyday)

Start With a Really Good List

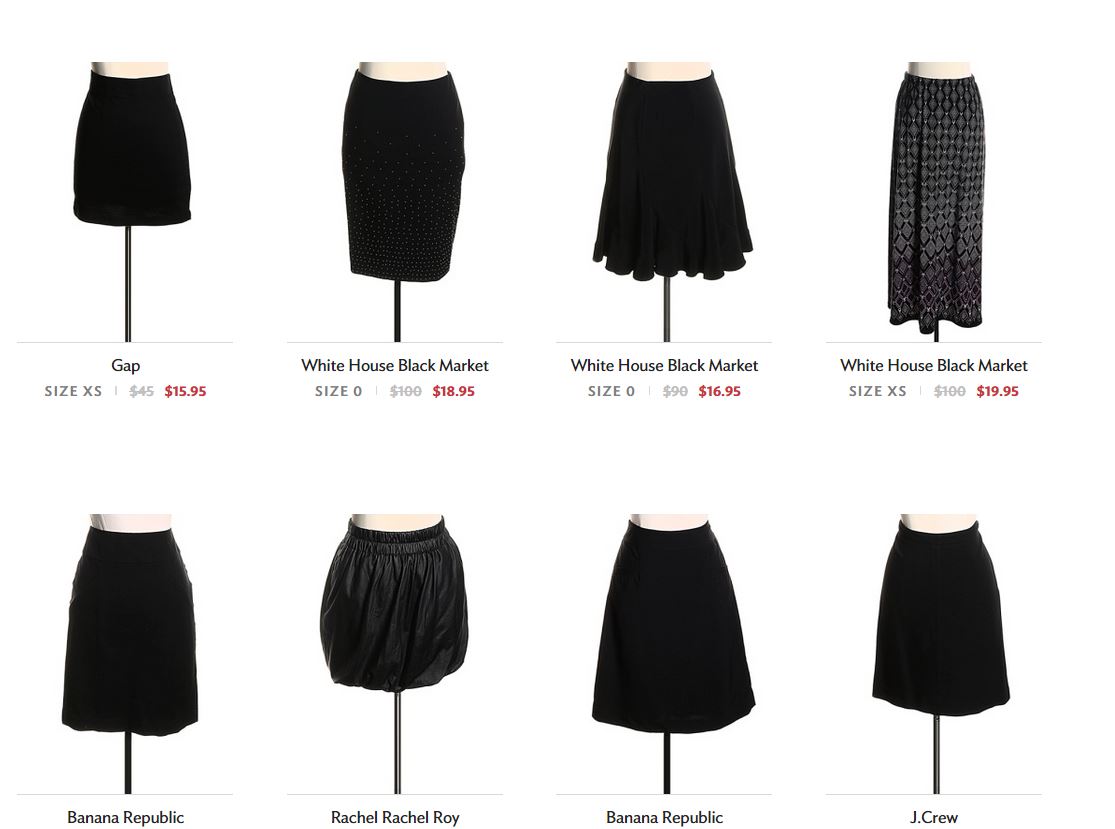

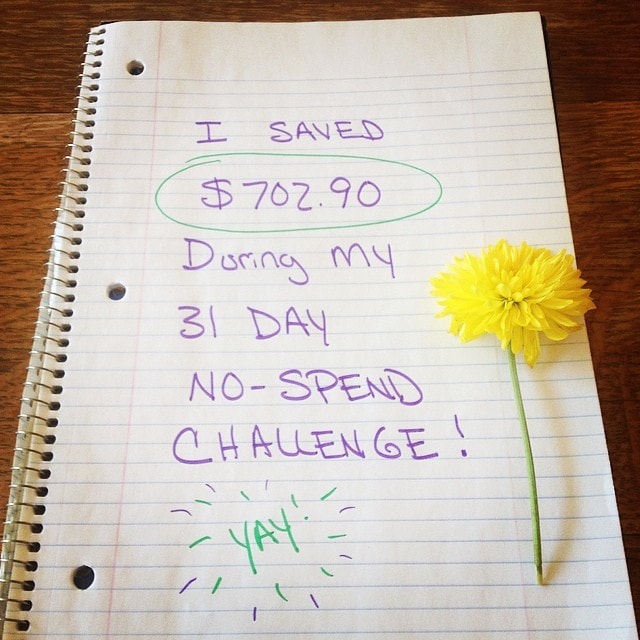

The capsule wardrobe relies a lot on wardrobe staples and I had none of these when I started. Even though secondhand shopping is more affordable than purchasing the items retail, you still must keep your budget in mind. Make a list of items that are important to you to own this year and consider dividing your list into the different capsules. For me, items like a good pair of jeans, a crisp white collared shirt, a black skirt, a black pair of jeans, a jean shirt, and a good blazer were all wardrobe essentials. Consider this list and this list (pictured above) as a good starting point for building your wardrobe.

Build In a Few Trendy Pieces

Once you have covered the basics, you can start jotting down a few of your favorite trends this season that you would like to incorporate. I love this list of Spring trends that include adding a bit of floral, the mixing and matching of bright & bold, a nod to denim, a fresh summer scarf, and the addition of a good clutch. Obviously, only embrace the trends that really work for you and for your lifestyle, otherwise, it ends up being a pointless task in incorporating these items if you will never wear them.

Always consider the trendy colors of the year to as a way to add a little bit of color to your capsule, while keeping it timeless with still embracing the basics.

Shop Around

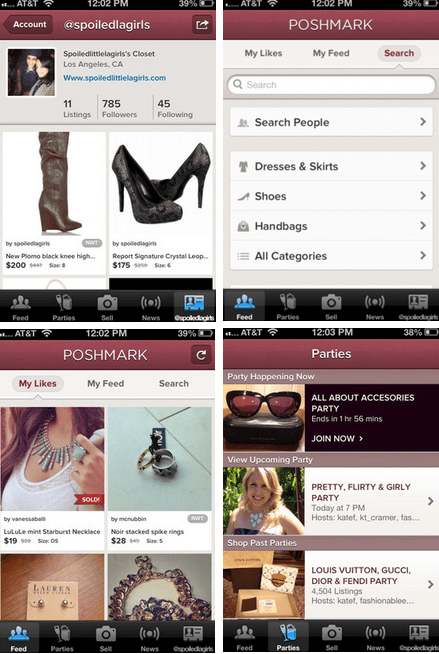

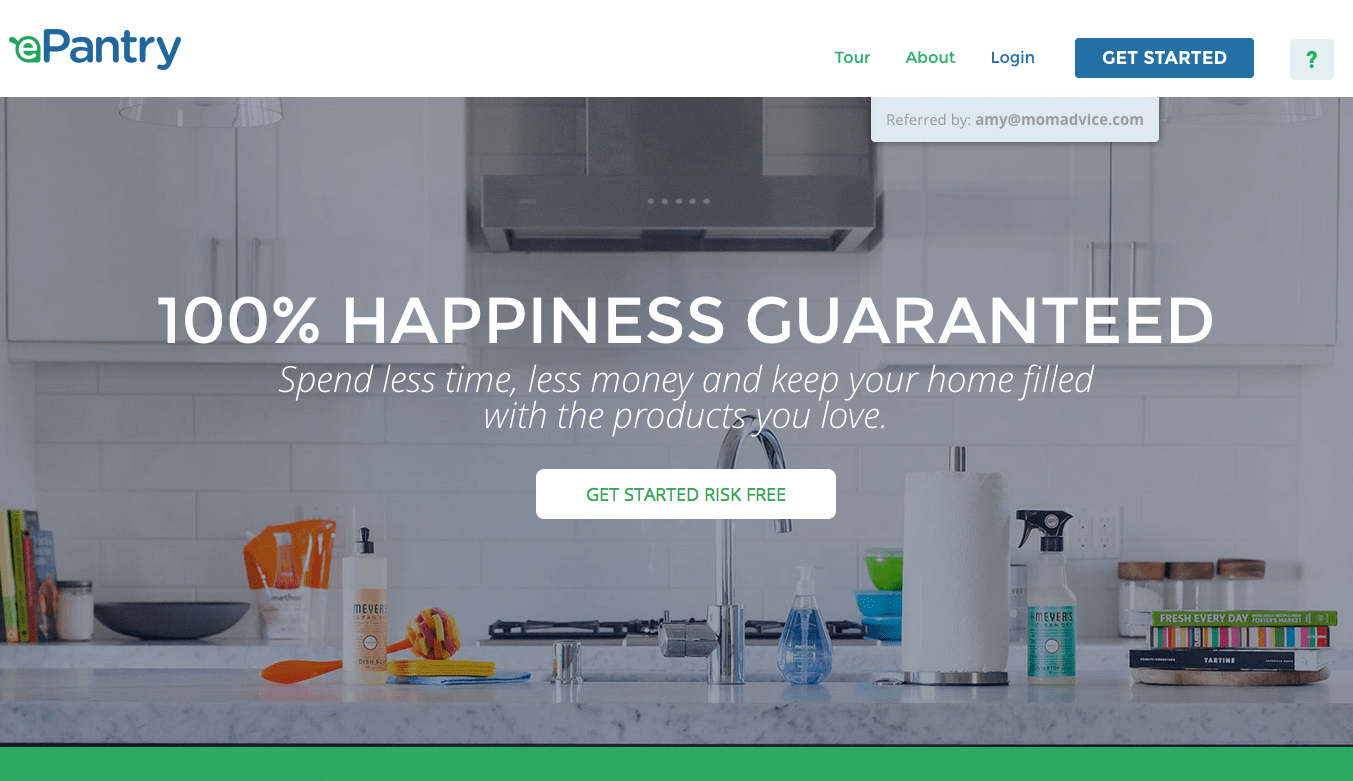

There are lots of great online consignment shops out there, you just have to find the right one for you. I have had the best luck on Twice and on thredUP (both of those are affiliate links and will give you $10 towards your first purchase). Here is a list of all of the shops that I have found to do some online consignment shopping. I have found that a lot of my happiness with a site and what they offer really relies upon their search tool since I like to shop with my list and not blindly hunt for items.

I would say after trying several different companies out for online consignment, my happiness has really been with Twice the most. I like that I have 30 days to try things on and make sure I really love it. I appreciate the convenience of being able to ship my returns without getting charged for shipping or restocking fees. I feel like I have been able to make smarter decisions and am not keeping items just because I don’t want the expense or hassle of returning them.

Of course, consignment shopping can happen locally too and many consignment shops are on Facebook, sharing and posting some of the best offerings they have in their store. Consider following the shops you love and keeping your eyes peeled for smart purchases for your capsule.

(source Twice)

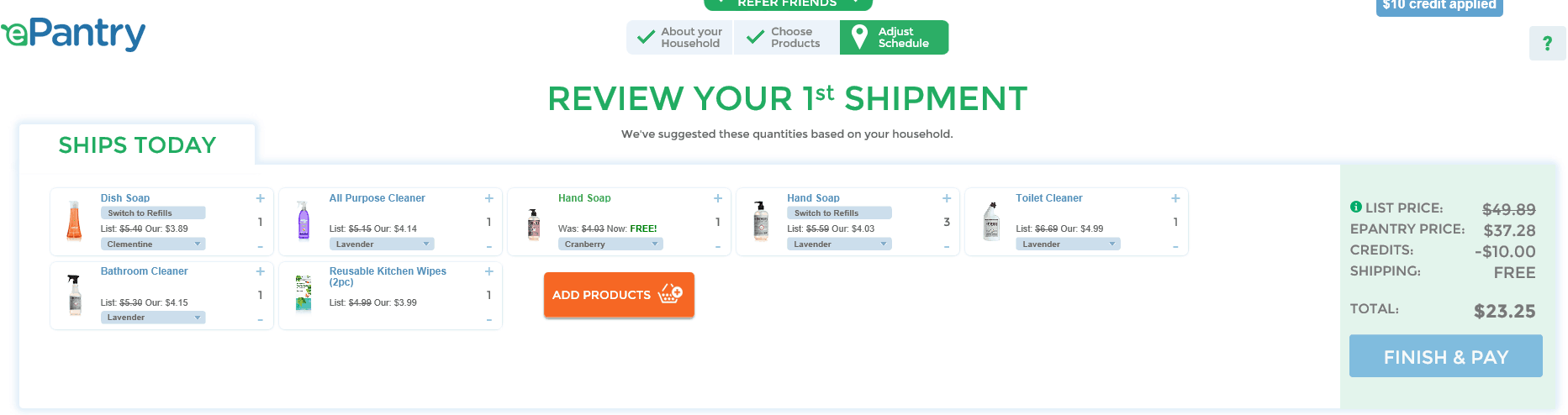

Start Shopping With Your List

Once you have a list of items that you really want, shopping for consignment online is a breeze. I begin typing in descriptions of the items I am after and let the hunting for them begin.

Start with your basics and type in the key phrases of what you are looking for.

“Black Skirt”

“Black Pants”

“Shirt Dress”

“Tunic”

Type in the patterns of fabric you are looking for- stripes, gingham, checks, herringbone, floral, chambray…. the possibilities are endless.

Be a Brand Snob- You Can Afford To

I have become quite the brand snob with my clothing and the reason is simply because I am buying my clothes at a fraction of the cost that I used to. I don’t want to spend the money on a pair of socks from some of the brands that I have been shopping at in their stores, but I can have a whole outfit when I purchase it on consignment…and not feel one bit guilty.

I try not to be too trendy in my capsule wardrobe and so I look to brands that I know will wash well, will have longevity, and won’t fall apart on me.

Sell It Back

Since you are keeping a well-edited closet with your fashion capsule, you will know right away what hasn’t gotten worn and won’t carry over to the next wardrobe. Consider making some money or credit for the clothes and sell them back to the retailers you purchased them from. I have this handy resource list on how to make money organizing that closet.

(source thredUP)

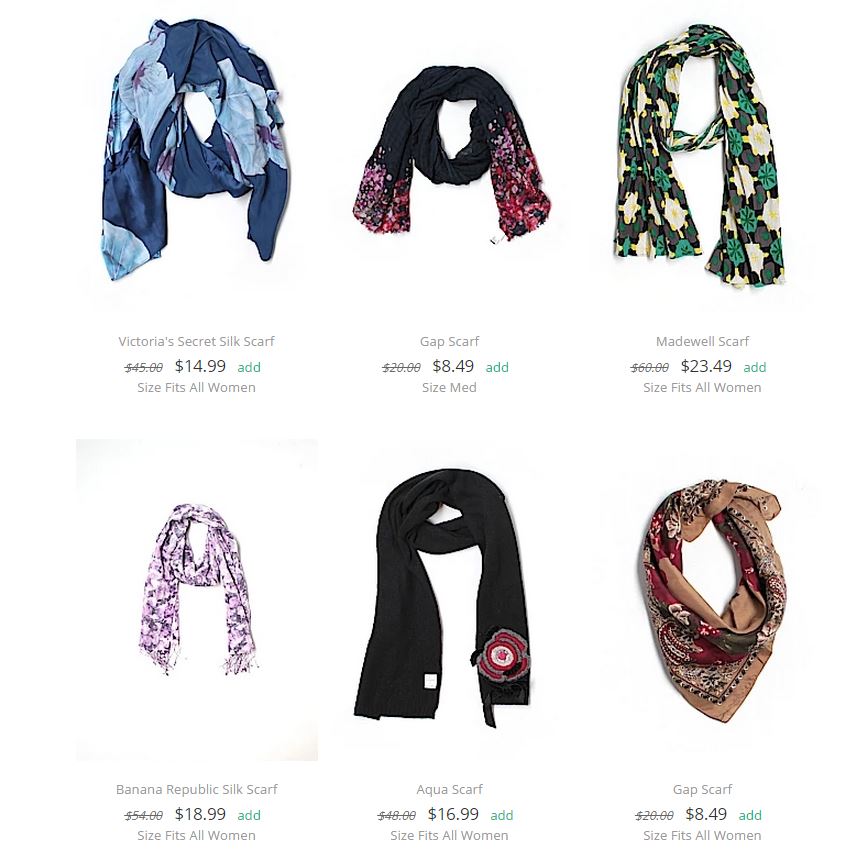

Add In Your Accessories & Shoes Secondhand Too

Not only is buying secondhand great for your wardrobe, but it can be great for shoes, purses, scarves, and belts to compliment your items. If there is a trend like, “emerald green,” or “floral print,” consider adding these into your wardrobe with accessories instead of with your wardrobe basics. A quick browse on thredUP yields a million floral scarves and at a much better price than the retail stores. These smaller items are a great way to add something trendy without deciding which trends you think will actually stick in your capsule wardrobe.

Last spring’s buttery Italian suede smoking slippers from J. Crew were available on Twice when I was putting together my capsule. Would I have spent $200 on these for myself? No way! I can afford a little luxury when they are priced at $60, use my referral credit, and pay a mere $5. YES! This is a luxury that this cheap lady can indulge in. They are beautiful and worth all five dollars and MORE!

The same principle can be applied to that beautiful handbag you have been dreaming of.

This has always been my secret to good shopping…

You can have the beautiful things you always wanted with a little patience- someone is always editing their items and the chances are good that ONE THING you have been dreaming of will be yours one day.

I waited a whole year for these shoes and it was worth the wait.

What are your tricks for shopping secondhand for your clothing? Feel free to leave them below!

Pin It