Are you looking for easy ways to earn extra cash for your family? Today I’m sharing how easy it is to invest in YOU with an incredible robo advisor tool. Ellevest is committed to helping you achieve your financial goals by investing in yourself and in women-owned businesses.

This is the second challenge in our Passive Income for Busy Moms series. Be sure to visit our Passive Income Ideas for Moms Series all year long as I challenge myself to find new ways to earn money for our family.

Does the idea of investing in yourself feel intimidating?

You aren’t alone.

I have always been intimidated by this process and, honestly, have never invested in my own retirement. Although we have been aggressively putting money away in my husband’s retirement account, I started thinking about how nice it would be to take some of my own salary and start investing in myself.

The thing is… where do you even start?

I spent weeks and weeks researching different companies, reading reviews, and watching interviews with representatives from different investment companies. It is through that research that I stumbled on the most incredible investment company that makes it UNBELIEVABLY easy to start investing in all of your financial goals.

Honestly, I am so excited about this and can’t believe how sleekly automated and easy this tool is.

First of all, are you unfamiliar with how robo-advisors work?

I know I was!

I will walk you through everything I have learned this month!

Also, for the record, this is a REAL review of Ellevest based on my first month with them. Many of the reviews I read NEVER had a REAL PERSON using Ellevest for investing- they just seemed to be in it for affiliate money.

Anything I share with you, through this series, are things that I’m exploring right along with you. It is my promise to you.

Earn Money Investing in Women With Ellevest

What The Heck is a Robo Advisor?

Robo advisors (also known as automated investing services or online advisors) use computer algorithms and advanced software to create an investment portfolio for you. They are referred to as robo because this is mostly an automated process that requires little to no human interaction.

This is a really great way to get started with entry-level investing because everything is done automatically for you and you don’t have to spend a lot of time babysitting your portfolio.

These robo-advisor tools can vary based upon their platform that they offer and what the goals of your portfolio are.

The reason I settled on Ellevest is because it is a goal-oriented program (something I find very attractive!), it is user-friendly, and their impact portfolios are pretty darn awesome.

What is Ellevest And Why Did You Pick It?

As I explained, I did a ton of research and spent many nights reading article after article on different investment tools. The idea behind this series was that it would be easy to implement and that it wouldn’t require a ton of time for a busy mom.

It is through this research that I stumbled upon this interview with Sallie Krawcheck on The Daily Show.

I really encourage you to take the time to watch it because it does a much better job than I ever could on just how important it is to support women in business and why this company is pretty groundbreaking.

As you can see, this lady is a real bada$$ and wants to do a better job representing women in the financial industry. This approach to simplify investing makes long term goals simple and straightforward.

From the Ellevest site, “Co-founder and CEO, Sallie Krawcheck, realized the investing industry has been, frankly, “by men, for men” — and has historically kept women from achieving their financial goals. Sallie has made it her life’s mission to unleash women’s financial power and get them invested in their biggest goals.”

How Much Money Do I Need to Open an Ellevest Account?

Honestly, you can open an account and invest zero dollars.

Of course, that’s how many you will make back too.

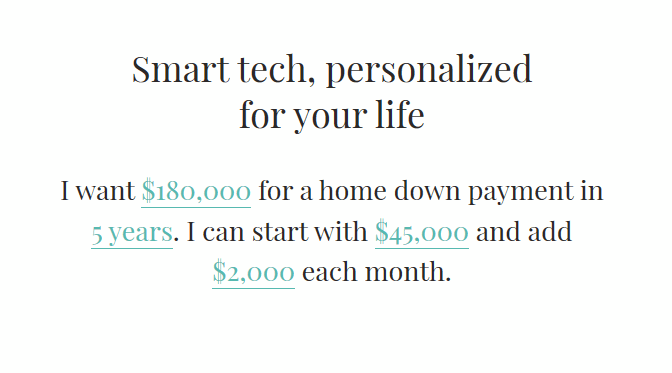

In all seriousness, you determine how much you want to invest to start and then Ellevest offers up how much you should regularly be depositing to reach your goals, within your desired timespan.

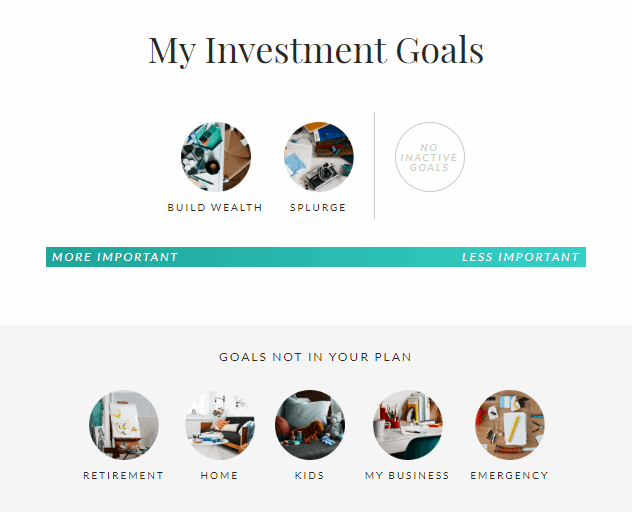

They also understand that women also need other types of shorter term or once-in-a-lifetime type of investments. They create this investment plan and then offer options for other goals based accounts.

Some of the offerings are funds to start a business, once-in-a-lifetime splurges, retirement, kids, buying a home, and emergency funds.

How Does Ellevest Determine My Investment Goals & Strategies?

Ellevest uses a algorithm to calculate financial goal targets to meet your specific needs, including a larger retirement target amount for your potentially longer lifespan (ladies, we need to save MORE because of that!).

Did you know that women retire with two-thirds as much money men do, but we live six to eight years longer?!

These are the circumstances that are factored in with a company that understands women.

Once they have calculated the amount you should aim for, they suggest how much you should contribute in order to get there based on your financial profile, a gender-specific salary curve, and your target horizon.

This is processed through a Monte Carlo simulation.

What the heck is Monte Carlo simulation?

My thoughts exactly.

Monte Carlo simulation is a forward-looking, computer-based analysis in which they run recommended portfolios and savings rates through hundreds of different economic scenarios, to pick the best one for you.

How Is Ellevest Supporting Women?

Is it just me, or are you as jaded as I am when people make broad claims about how they support women?

In this case, they REALLY do.

A lot of people love to aim products towards women, but really don’t stand behind that message.

This is where my real love for the company is…they tailor a portfolio that helps YOU support WOMEN IN BUSINESS!

Is that not the coolest?

They settled on three criteria of support that I think are really amazing (not to mention hiring female investors to work on your accounts):

WOMEN IN LEADERSHIP

Funds investing in companies with more women leaders and policies that advance women.

SUSTAINABLE, ACCOUNTABLE COMPANIES

Funds investing in companies working to meet for sustainability and ethical practices.

COMMUNITY DEVELOPMENT

Funds providing loans to support women-owned businesses and companies that provide community services – child education, performing arts, and housing and care for seniors and individuals in need.

How Hard is It to Create An Account?

This was incredibly easy to set up and it all made sense to me because of its goal driven platform.

They use a tool, that my hubby immediately recognized as a TypeForm template, that I found very easy to use.

You answer some really basic questions, like in the screenshot above, and that helps you see how much you need to put away each month to reach your goals.

Once it has this information, you can set up how much you want to start putting away into your accounts automatically.

Just like a withdrawal you would have for a bill, this takes out the payments you set up monthly.

You can also add additional money into your account and there is no minimum balance.

If you earned money from one of the other passive income ideas I’m sharing, for example, you could put this unexpected money away for yourself to earn a little more.

How Much Does Ellevest Cost?

This tool is much cheaper than hiring a financial advisor because more personalized services can charge you a whopping 1% annually.

With Ellevest, your annual management fee is .25%.

If you saved $5,000, for example, you would pay $12.50 for the entire year.

They do offer a more expensive premium account that allows you to receive coaching and some other benefits.

For that account though, you need a minimum private wealth investment of $50,000.

Is Investing Money With Ellevest Risky?

Investing does come with risks and it is important to understand what those risks are.

I found this article to be very helpful in explaining what risks might be involved.

Why Did You Start This a Month Before Me?

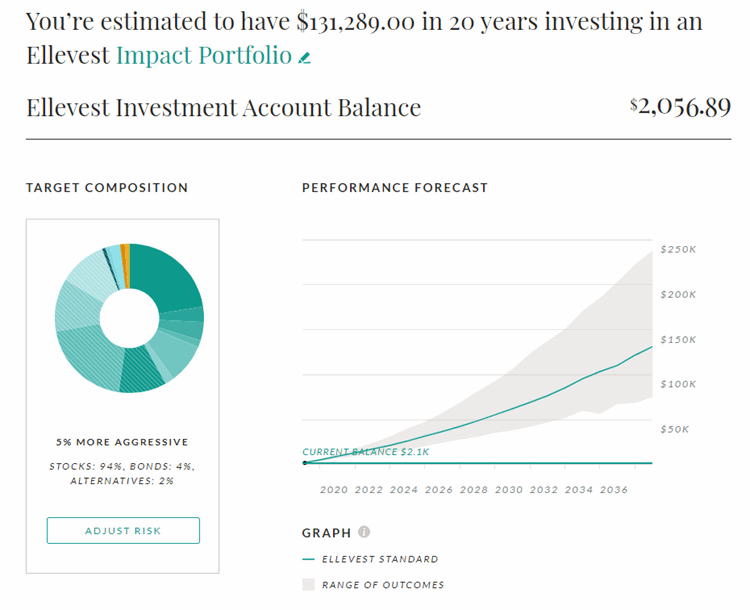

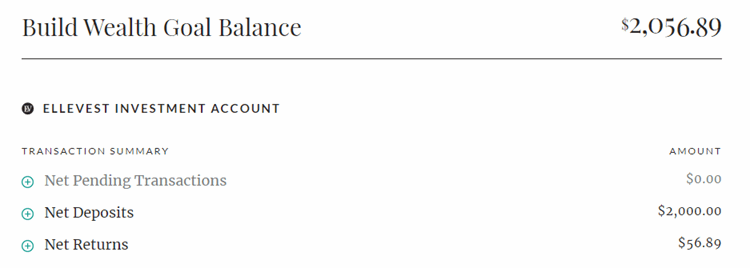

With something like investing, I thought it was important to do the entire process so that I could be honest about how easy or hard it is. I put in $2,000 into a wealth-building account.

This is my current status for potential earnings!

Of course, investing is a long haul game, but it is fun to see that needle shifting in my favor a bit.

Should I Be Investing If I’m Worried About a Recession?

Some experts are saying that a financial recession is looming.

Here’s the thing, I am going with these opinions and agreeing with the experts on this one. I do believe we will be facing another recession soon.

I think this is a valid concern and something that we all should be thinking about as we make choices with our money.

The most important thing you can do is to prepare an emergency safety net so that you can weather the economic changes.

The second most important thing?

Pay off your highest interest debts NOW.

If you need another gentle nudge, you might enjoy my book! (I’m pretty proud of it!)

I think this article does a really great job at explaining how to invest if you are worried about another recession.

The biggest thing I am learning from wealth-building is that it is REALLY important to keep things diversified.

Never put your eggs into one basket.

Your challenge is to set up an account and invest in yourself. If you only have $5 a month, that is $5 more towards reaching a financial goal FOR YOU.

Start brainstorming with your family about what would benefit you the most right now.

Putting your savings and investments on automatic makes it easier to stay on track with your financial goals.

Please note, this Ellevest affiliate program is not associated with being a blogger.

Also, let it be known, although I love the focus on women, men are more than welcome to invest too.

If your guy is as awesome as mine, he will love putting his money towards companies that are helping women level the financial playing field.

Love this post? Here are a few others that I think you might love too!

I’d love to hear what has been your experience with Ellevest or with using a robo-advisor for your investments? How do you make investing in yourself and your retirement a priority?

this post contains affiliate links

Pin It